Sri Lanka’s exports as a share of GDP has declined from 33% in 2000 to 13% in 2015. One of the solutions has been to diversify Sri Lanka’s markets. This is because over 50% of Sri Lanka’s exports go to the EU and the United States; and India and China absorb only 7% and 2.9% respectively. A previous Verité Insight titled “Solving dilemma of export diversification” pointed out that the bottleneck might not be in a narrow set of markets, but in a narrow set of products. Over 50% of Sri Lanka’s exports are Apparel and Tea, and the markets Sri Lanka accesses are appropriate to these products. Therefore, solving the export problem requires giving attention to diversifying products as well, not just the markets.

The present analysis looks at the success of product diversification with regard to exports to India – signaling both a diversification from traditional markets and traditional products.

This success in diversification, however, conceals some vulnerability. A majority of the products Sri Lanka is exporting to India are overly dependent on preferential trade terms with India – so they succeed only in India. This makes them vulnerable on two counts: the reversal of preferences, or the dilution of preferences. The latter is more likely due to India’s aggressive push towards FTAs with a large number of competing countries. This poses a challenge for sustaining export growth to India in the long run.

The key insight of this analysis is that the problem of having single-product markets is not robustly solved by diversifying to single-market products – especially when they depend on preferential terms of trade.

Single-product markets

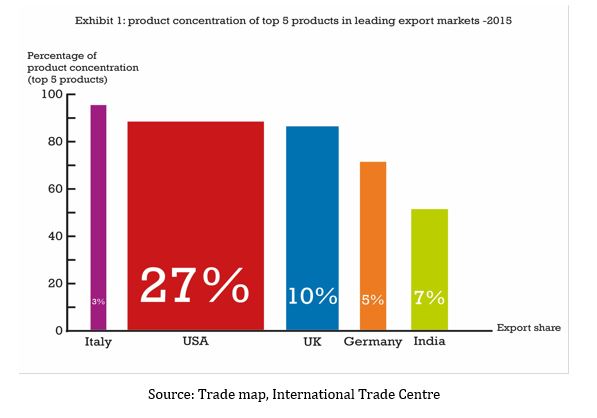

The term single-product market is used to describe markets that are penetrated by a very few products – one in the extreme. Economists call this “product concentration”. That is, very few products make up most of what is sent to that market. A simple way to measure product concentration is to ask what share of the total sales is accounted for by the top 5 products.

Exhibit 1 shows the concentration of the top five products in the top five export markets of Sri Lanka. These five countries accounted for 52% of the country’s exports in 2015. The Exhibit shows that, of the top five markets, exports are least diversified to Italy (highest level of concentration) and most diversified to India.

Single-product markets are a source of vulnerability, especially if the market also accounts for a large share of Sri Lanka’s exports. The US market with 88% concentration may represent a greater vulnerability than Italy, with a 95% concentration, because the US takes 27% of Sri Lanka’s exports, while Italy takes only 3%. For example, Sri Lanka’s apparel exports to the US could be vulnerable to a loss of competitiveness consequent to new trade agreements by the US such as the Trans Pacific Partnership which includes Vietnam.

Single-market products

The term single-market product describes a product that sells to very few markets – one in the extreme. Economists call this high “market concentration”. Market concentration is measured by dividing the total exports of that product by Sri Lanka to a particular market, by the total exports of that product to the world.

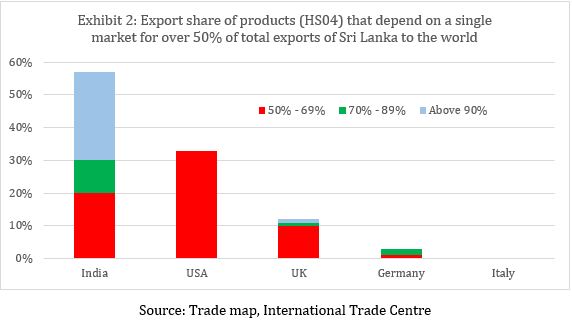

The extent of market concentration can be looked at in two ways. (1) The number of products (say of the top 20) that have more than 50% market concentration. (2) The share of exports to a country that are accounted for by products that have more than 50% market concentration. In both these respects India shows up as the country with the highest market concentration.

- 13 of the top 20 products exported from Sri Lanka to India have a market concentration of over 50%. In comparison, the US, UK and Germany have only six, three and two products of the top 20 that have a market concentration of over 50% and there is none for Italy.

- As a share, the products that have more than 50% market concentration account for 57% of Sri Lanka’s export value to India. For the US, UK and Germany, this is only 33, 12, and 3 percent respectively and there are no such products for Italy (Exhibit 2).

Single market products are a source of vulnerability, because any factors that disrupt trade with that country can hugely affect the export of that product – as the product lacks alternative places of export.

Product concentration based concessions by India adds to vulnerability

On the face of it, Sri Lanka’s diversity of products to India looks positive; and it is. But the numbers show that this diversity is connected to high market concentration – that is these products sell mostly to India, not much elsewhere.

Heavy concentration of products in India’s market is a source of vulnerability in three ways. First, shocks in India’s market with regard to these products can have large ripple effects in Sri Lanka as well – undermining production and jobs. Second, if the products depend on a high level of concessions under the India-Sri Lanka Trade Agreement then they are likely to be succeeding because of the concessionary terms, not because they are sustainable on competitive criteria of quality and price. Third, India’s tariff liberalisation and accession to new trade agreements can dilute Sri Lanka’s concessionary advantage. All three are the case.

- Of the 13 products with over 50% concentration, 6 have over 90% concentration in India, and account for over one quarter of Sri Lanka’s exports to India (see Exhibit 2). These products sell mostly to India, not much elsewhere, and are vulnerable to large shocks, based on small changes in the Indian market environment.

- Of the top 6 concentrated products 100% of Sri Lanka’s areca nut production goes to India, and Sri Lanka enjoys zero duty compared to 100% duty faced by competing countries. Animal feed has a 99% product concentration and Sri Lanka enjoys zero duty compared to 30% by competing countries. These two exports alone account for almost one fifth of Sri Lanka’s exports to India.

- India is vigorously entering into FTAs with other countries. In just two years (2010-2011), India entered into four major trade agreements with ASEAN, South Korea, Malaysia and Japan; a further 14 are under negotiation. This and unilateral trade liberalization by India is likely to result in an “erosion of preferences” for Sri Lanka.

Sri Lanka is looking to speedily reverse the long contraction in its export share of GDP. The hunt for new markets requires the ability to be competitive with a wider range of products. India is an example where Sri Lanka has diversified its product range. However, this is a fragile success because it depends inordinately on concessionary terms under the trade agreement with India. This Insight points out the vulnerability that emerges from this apparent success. Resilience in export growth requires Sri Lanka to look beyond short term preferential access to foreign markets for export success and focus on improving the competitiveness of a wider range of products.