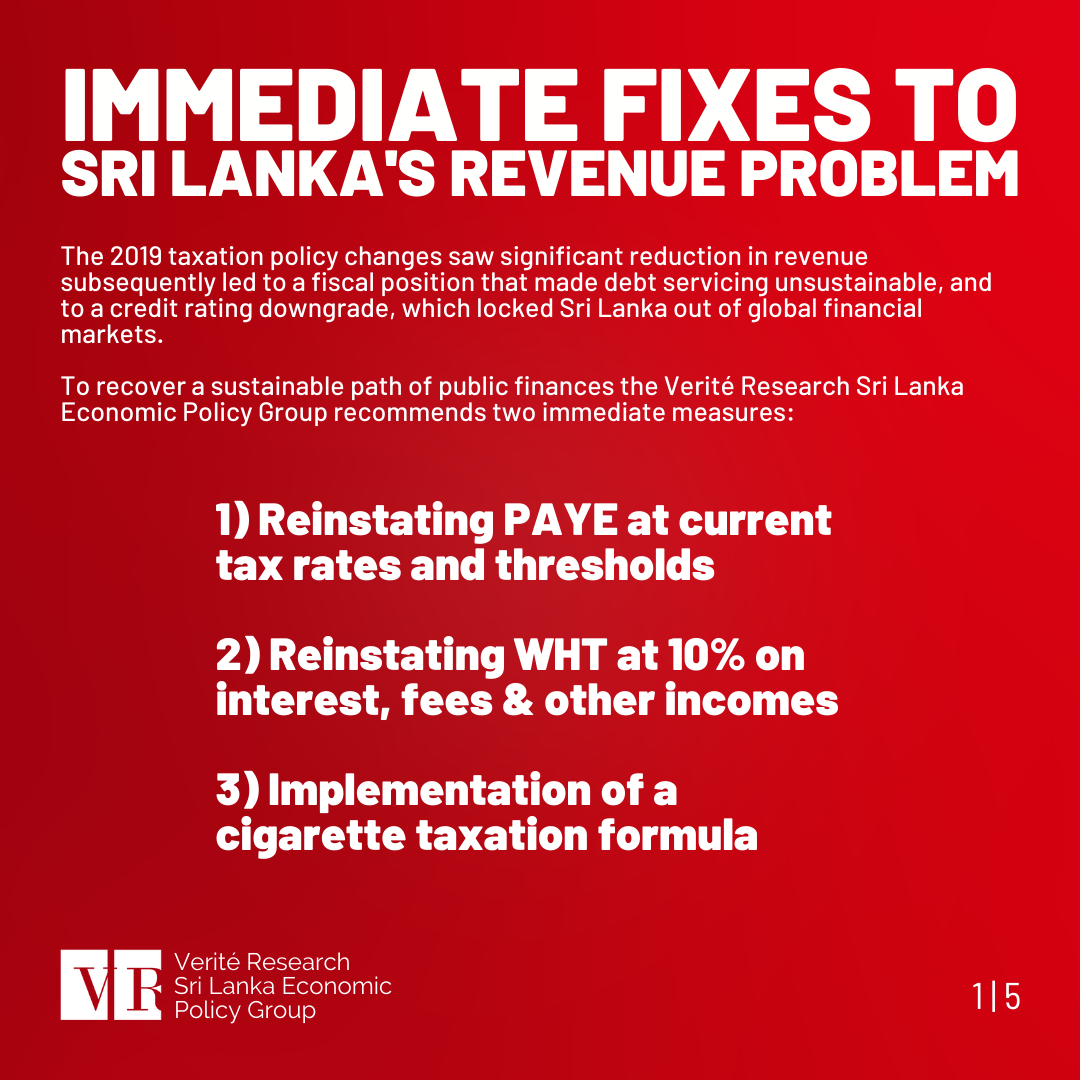

Major taxation policy changes announced in December 2019 included the removal of Pay-As-You-Earn (PAYE) and Withholding Tax (WHT), which were efficient tax collection mechanisms. Sri Lanka also silently abandoned an indexation-based tax collection formula for cigarettes that had been approved in the 2019 budget. These and other major changes to tax policy were implemented without an analysis of consequences.

To address the severe economic crisis and Sri Lanka’s revenue problem, the new Verité Research Sri Lanka Economic Policy Group led by experts Dr. Nishan de Mel, Prof. Dileni Gunewardena, Prof. Shanta Devarajan and Prof. Mick Moore makes the following key policy recommendations:

Re-introduction of WHT and PAYE tax collection methods: The note provides an analysis of reinstating PAYE at the current reduced levels of taxation and WHT at a collection rate of 10%. These measures would enable Sri Lanka to gain an additional LKR 75.4 BN in 2022 and LKR 184.2 BN for 2023.

Cigarette Taxation Formula – the cost of forgetting: The note details the methods and calculations for implementing the taxation formula, that would help reduce the delays, under-taxation and discretion, in cigarette tax adjustments. The Verité Research Economic Policy Group finds that failing to implement the cigarette taxation formula is resulting in a revenue loss of LKR 35.5 BN in 2022 and LKR 45.2 BN in 2023.

Overall, by reinstating PAYE, WHT and the formula on cigarette taxation immediately, the government stands to gain an additional revenue of LKR 93.1 BN in 2022 and LKR 229.3 BN in 2023.