Published in the DailyFT

On 9 July 2021, the government gazetted a new finance bill aimed to indemnify individuals who voluntarily disclose their hitherto undisclosed income—that is to a provide a tax amnesty.

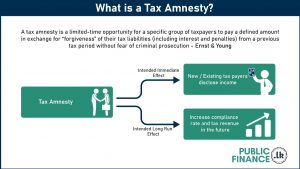

A tax amnesty is a limited-time opportunity for a specific group of taxpayers to pay a defined amount (redemption fees) in exchange for ‘‘forgiveness” of their tax liabilities (including interest and penalties) from a previous tax period without fear of criminal prosecution (Ernst & Young, 2016)

A Tax amnesty is usually used as an instrument to draw the undocumented sector into the economy, with the goal of increasing tax compliance in the future.

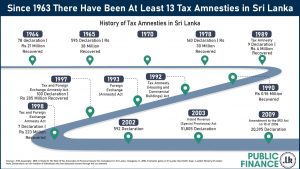

Sri Lanka has had a history of providing frequent tax amnesties from 1964 till 2009.

Tax amnesties provided until 2003 were mainly focused on income tax or foreign exchange amnesty. However, from 2003 onwards, tax amnesties also covered a range of taxes, including Income Tax, VAT, Wealth and Gifts Tax, Turnover tax, Surcharge on Wealth Tax, GST, ESC, NBT, Betting and Gaming Levy, and Stamp Duty.

The number of declarations— meaning the number of individuals disclosing income through the tax amnesty—has been low in the past, as can be seen in the above infographic. However, in 2003 and 2009 the number of declarations increased to 51,805 and 20,395 respectively.

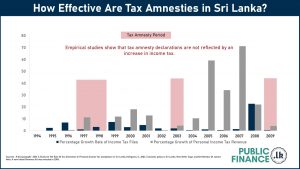

There have only been a few quantitative studies performed on the effectiveness of tax amnesties in Sri Lanka. One such study by R.M. Jayasinghe (2010) analyses the impact of tax amnesty on income tax using the number of tax files and personal income tax revenue during the tax amnesty period.

The study concludes that past tax amnesties in Sri Lanka have not translated to a higher income tax revenue or greater tax files. This is despite a higher number of declarations being recorded in 2003 and 2009. This conclusion thereby suggests that the tax amnesties were ineffective in achieving their goal.

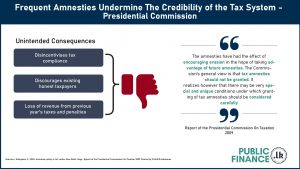

Frequent tax amnesties can also have other unintended negative consequences which can have lasting impacts on a tax system.

Frequent tax amnesties may lead to lower tax compliance as they could create an incentive for non-compliant entities to avoid declarations until the next amnesty.

Further, they discourage compliant tax payers since non-compliance is rewarded; tax evaders can be indemnified with a low one-off payment, whereas the compliant have paid the full tax rate.

Frequent tax amnesties can also result in a loss of government revenue due to the foregone collection of previous years’ taxes

Together, these factors result in undermining the credibility of the tax system. For this reason, the IMF in a report titled Tax Amnesties: Theory, Trends, and Some Alternatives (2009), concludes that repeated tax amnesties generate diminishing revenue.

The Presidential Commission on Taxation chaired by Professor W.D. Lakshman in 2009 recommended that governments refrain from providing tax amnesties in the future apart from under very special circumstances. The Commission proposed alternative tax reforms in three broad categories to improve tax revenues, including (1) expanding the number of tax registrants; (2) improving enforcement; and (3) enhancing tax administration to improve compliance.

A specific recommendation of the Commission on the subject effective enforcement is stated as, “Firm policy statements indicating that there would be no tax amnesties in the future. As the Moral Hazard element attached with tax amnesties encourage under payment of taxes” (p. 329).

Sources;

R.M. Jayasinghe, A Study On The Role Of Tax Amnesties In Personal Income Tax Compliance In Sri Lanka, (2010).

Saman Kelegama, Economic policy in Sri Lanka, (New Delhi: Sage, 2004).

Report of the Presidential Commission on Taxation, (2009) chaired by Prof W D Lakshman

Baer, K. and Le Borgne, E., Tax amnesties. Washington, D.C, (International Monetary Fund, 2009).